State sales tax rises Sunday; VW 7.25%

DAVE MOSIER/independent editor

Starting this Sunday, most items Ohioans purchase in the state will be just a little bit more expensive.

That’s when a quarter-percent increase in the state’s sale taxes enacted by the Ohio General Assembly and signed into law by Governor John Kasich in June takes effect.

That’s when a quarter-percent increase in the state’s sale taxes enacted by the Ohio General Assembly and signed into law by Governor John Kasich in June takes effect.

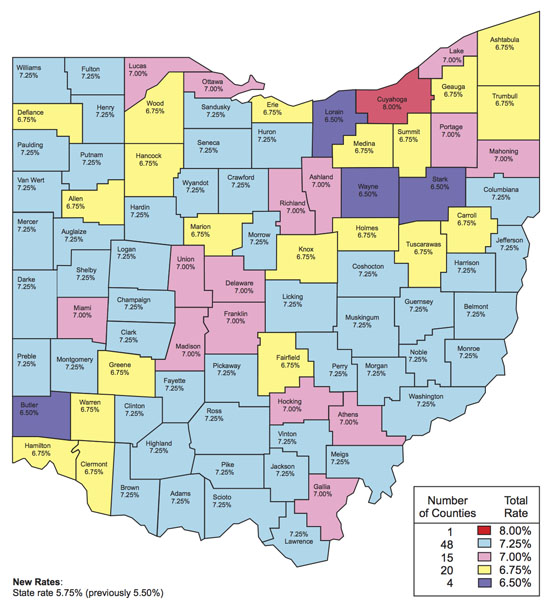

When the new sales tax rate goes into effect on Sunday, Ohio will have a base sales tax of 5.75 percent, up from the current base of 5.5 percent. However, counties also have the choice of adding up to 1.5 percent additionally in the form of permissive taxes.

Here in Van Wert County, residents will pay the maximum of 7.25 percent on items purchased in the county. That’s the same rate paid in most neighboring counties, with the exception of Allen County, where the sales tax rate is a half-percent less at 6.75 percent.

The new sales tax rates mean that those who purchase an item worth $100 will pay an extra quarter in new sales taxes. For a $20,000 car, that would be an extra $50 in sales taxes.

Also rising this year will be new property taxes after the state legislature adopted new tax reform guidelines that, in essence, removes the tax rollback regulations first passed in House Bill 920 back in the 1970s, when property taxes were excessively high.

There is at least one positive, though, as the General Assembly also approved a cut in the state income tax that is retroactive to January 1 of this year.

The state sales tax was first introduced in Ohio in 1935 and was 3 percent. The tax increased to 4 percent in 1967 and was at 5 percent in 1981. It reached its highest total in 2003 at 6 percent, but was then decreased to its current 5.5 percent in 2005. The new tax hike is the first in eight years.

POSTED: 08/31/13 at 7:34 am. FILED UNDER: News