Ohio A-G issues warning on tax scams

Submitted information

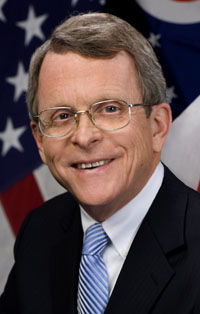

COLUMBUS — Ohio Attorney General Mike DeWine warns that more consumers are reporting tax-related scams with about four weeks remaining until the April 18 filing deadline.

In 2017, the Ohio Attorney General’s Office has logged more than 150 tax scams thus far in March, compared to 80 in January, and 175 in February.

“As we get further into tax season, we’re seeing more of these scams,” Attorney General DeWine said. “What we want people to remember is that if callers are threatening you, saying you have to pay immediately, or saying they’re going to put you in jail, it’s not the IRS.”

The most common tax scam reported to the Ohio Attorney General’s Office is the “IRS” imposter phone scam. The ploy generally begins with a call claiming the recipient is in trouble with the IRS and must call a certain phone number to avoid arrest or legal action. Eventually, the person is asked to pay to resolve the supposed problem.

Con artists commonly lie to people claiming they owe back taxes, they have unfiled returns, they have an arrest warrant in their name, they’re receiving a “final notice” from the IRS, they will be prosecuted for tax fraud, or their assets, wages, or bank account will be frozen if they don’t pay.

The scam artists often ask people to pay using iTunes (or other) gift cards, instructing people to read the card numbers over the phone. With this information, con artists can drain the card’s funds. Once the money is gone, it is nearly impossible to recover.

To avoid phone scams:

- Don’t trust threatening callers. Those who receive an unexpected phone call from someone who threatens to arrest them for not paying taxes should be very skeptical, especially if they never received any written notice.

- Avoid making payments over the phone. Don’t trust someone who demands that a person pay immediately over the phone using a gift card or prepaid card, or who demands that someone send a wire transfer. These are preferred payment methods for scam artists. The real IRS won’t demand that someone pay using one of these specific methods.

- Don’t respond to illegal robo-calls. Don’t interact with the caller, and don’t dial the number left on one’s phone. Responding to a scam call can result in even more calls.

- Don’t rely on caller ID. Scam artists can make it appear that their calls are coming from a local number or from a 202 (Washington, D.C.) area code number, even when they are located in another country.

- Check into call-blocking options. Check with one’s phone carrier and third-party services to determine whether call-blocking services could help stop unwanted calls.

During tax season, individuals also should beware of tax-related identity theft, which generally occurs when an imposter files a fraudulent tax return using someone else’s Social Security number in order to obtain that person’s tax refund. To reduce the risk of tax identity theft, individuals should file their tax returns as soon as possible and make sure they trust their tax preparer.

In addition to tax scams targeting individuals, employers (such as businesses, schools, and nonprofits) should beware of phishing scams aimed at getting their employees’ personal information. Con artists may send a spoofed email to an HR or payroll employee, requesting a list of all employees and their W-2 forms. The email may appear to come from the head of organization, when it actually is from a scam artist. Employers should beware of these scams and report any W-2 thefts immediately to the IRS.

Report potential scams to the Ohio Attorney General’s Office at www.OhioProtects.org or by calling 800.282.0515.

POSTED: 03/21/17 at 7:05 am. FILED UNDER: News